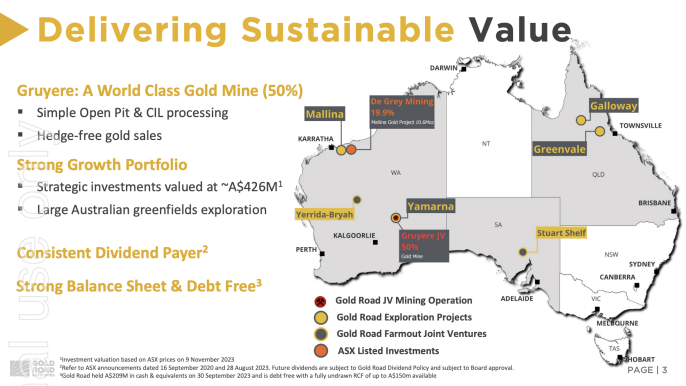

The year to date has produced a solid production performance at Gruyere and delivered an expansion of the Company's growth and exploration focus. Gold Road is not a truly national greenfields explorer with key projects at Yamarna and Mallina in WA and new assets in northern Queensland. Gruyere remains on track to produce 320,000 to 350,000 ounces (100%) for 2023, with Gold Road’s share at an attributable AISC of A$1,540-1,660/oz.

significant progress in 2023

Gold Road is awarded the prestigious Dealer of the Year award at the 2017 Diggers & Dealers Mining Forum in recognition of its Gruyere JV deal with Gold Fields.

Gold Road announces that Gruyere project engineering is 84% complete, construction 44% complete and EPC construction 17% complete.

Gruyere celebrates its one‐millionth ounce of gold production, less than four years since production commenced in June 2019. With the strong production outlook, Gruyere is set to deliver 2 million ounces during 2025. Once Gruyere has produced 2 million ounces, Gold Road will receive a 1.5% net smelter return royalty from Gold Fields on its 50% share of production. This is in addition to Gold Road’s 50% share of ongoing gold production.

of DGO Gold

one-millionth ounce

Gold Road completes the takeover of DGO Gold Limited (ASX: DGO). DGO owns a portfolio of prospective exploration and mining assets that include a ~14.4% shareholding in De Grey Mining, the owner of the nine-million ounce Mallina gold project in WA’s Pilbara region, a ~6.8% stake in Dacian Gold Ltd and an attractive portfolio of exploration tenements in the Pilbara, Yilgarn, Bryah and Stuart Shelf provinces. The acquisition of DGO aligns with Gold Road’s strategy to invest in high-quality gold projects in Tier 1 jurisdictions. In particular, Gold Road views the substantial shareholding in De grey as an exciting opportunity.

Gold Road presents its first stand-alone Sustainability Report – Mapping the Future – as part of strides in its sustainability journey and another step towards its vision to become an ESG leader within the gold mining sector. The report encompasses Gold Road’s environmental, social and governance performance for exploration and development activities and its 50% non-operating interest in Gruyere.

report delivered

Gold Road’s board declares a maiden dividend, of 1.5¢ per share, in respect of the company’s six-month period to 31 December 2020. 2020 was Gold Road’s first full year as a producer and a year during which the company paid down all debt and generated more than $105 million in free cash flow. Gruyere is a Tier-1 gold mine and Gold Road is only just beginning to unlock its full potential.

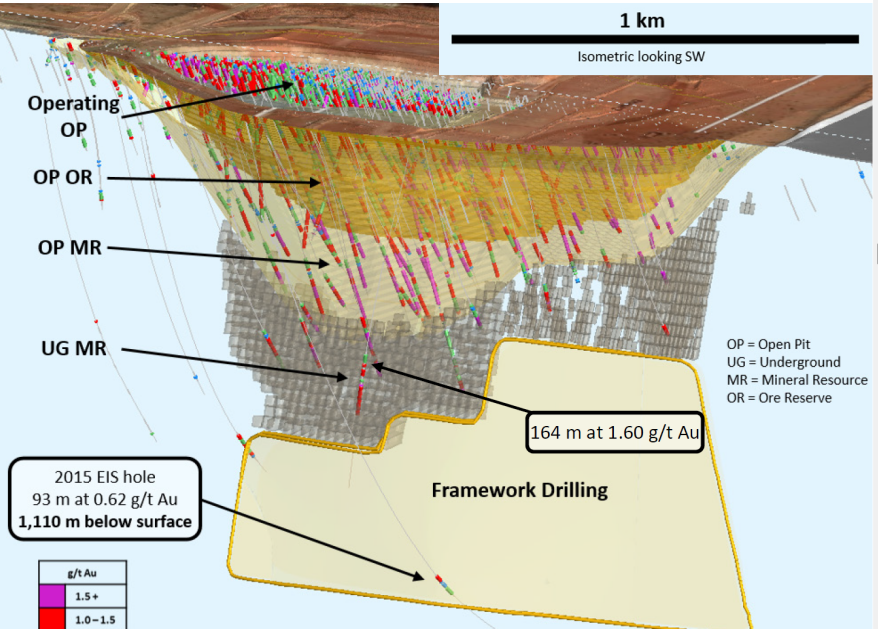

The Gruyere JV continues exploration at and around the mine site, including testing the underground potential beneath the open pit shell. Gold Road calculates a maiden underground mineral resource of 36.9 million tonnes at 1.47 g/t Au for a total of 1.74 million ounces – on a 100% basis. The reporting of a maiden inferred underground mineral resource is a meaningful advance in the JV’s understanding of the depth potential at Gruyere. Gruyere continues to show significant growth potential beyond the current 10-year ore reserve life.

maiden resource

A year since first production, Gold Road announces a maiden consolidated net profit after tax for the half year of $23.4 million. The journey has been an exciting one and an outstanding performance for an operation in its first year of production. The strong cash flow performance at Gruyere has enabled Gold Road to pay down all debt within less than 10 months from declaring commercial production.

maiden interim profit

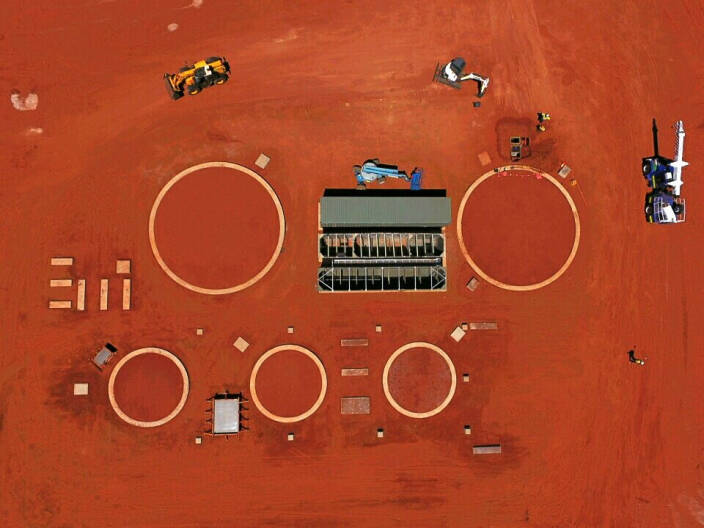

Australia’s newest gold operation – Gruyere – is officially opened and is safely ramping up to an average annual production of 300,000 ounces. The mine was officially opened by Western Australia’s Mines and Petroleum Minister, the Honourable Bill Johnston, in a ceremony at the site that was attended by representatives of the JV parties, key contractors and the traditional owners of the land on which the mine is located, the Yilka people. Bill Johnston said: “The Gruyere project is vitally important to Western Australia, not only because of its gold output but also because it will provide around 250 jobs over the next 12 years and open up a new gold province.”

Commercial production is attained at Gruyere, slightly ahead of guidance for mid-way through the anticipated ramp-up period of six to seven months. The ramp-up commenced after the commissioning of the ball mill in early August 2019.

commercial production

Long-serving Gold Road managing director and CEO Ian Murray announces his retirement. Duncan Gibbs is appointed his successor. Commenting on the leadership transition, Gold Road non-executive chairman Tim Netscher said that "in Duncan we have found a very capable new managing director, who will lead the next chapter of Gold Road’s growth".

for the future

Gruyere produces its first gold bars, enabling Gold Road to join the ranks of ASX‐listed gold producers less than six years since it made the Gruyere discovery. The three doŕe gold bars totalling 1139 oz and were produced from the carbon‐in‐leach and elution circuits. It marks the start of a new chapter for Gruyere, a global Tier 1 gold mine based on a world‐class orebody and with a forecast long mine life.

at Gruyere

Construction is underway at Gruyere after the JV partners received WA Government approval for the project management plan, mining proposal and mine closure plan.

start of construction

Gold Road enters into a 50:50 joint venture with South Africa’s Gold Fields for the development and operation of Gruyere. Gold Fields will manage the Gruyere JV company that will oversee construction, and then operation, of Gruyere. Gold Fields will pay Gold Road $350 million in cash and an uncapped 1.5% net smelter return royalty once Gruyere has produced two million ounces.

with Gold Fields

Gold Road signs a historic native title agreement for Gruyere with the Yilka People and the Cosmo Newberry Aboriginal Corporation (CNAC). The signing, which was witnessed by WA Mines Minister Sean L’Estrange, marked the first native title mining agreement entered into by the Yilka People, the traditional owners of the land. This is also the first native title mining agreement across the entire Yamarna Belt.

access agreement

Additional drilling and discoveries have led Gold Road to declare an increase in Gruyere’s Mineral Resource to 137.81 million tonnes at 1.24 g/t Au for 5.51 million ounces of gold. The Gruyere deposit remains open, particularly at depth, with the potential for mineralisation being tested with a deep diamond hole.

grows to 5.51moz

Less than a year since Gruyere’s discovery, Gold Road completes a maiden Mineral Resource estimate of 96.93 million tonnes at 1.23 g/t Au for 3.84 million ounces of gold. Of the overall Mineral Resource, 41% of the ounces are in the Measured and Indicated categories status. It took 38,000 metres of diamond and RC drilling to complete the resource.

mineral resource

maiden Gruyere mineral resource

Gruyere produces

one-millionth ounce

Successful

takeover

of DGO Gold

Maiden dividend declared

Maiden interim profit

First gold produced

at Gruyere

Gruyere construction in full flight

Gruyere construction underway

Yilka land

access agreement

Gruyere resource

grows to 5.51moz

GRUYERE'S DISCOVERY

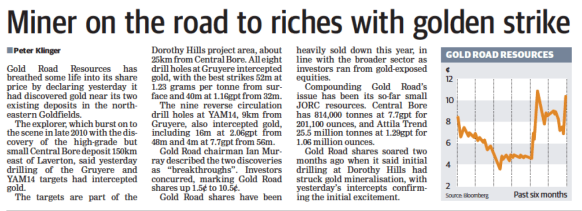

Gold Road discovers a new trend of gold mineralisation in the first-pass RC drill program on the Dorothy Hills trend, at the Gruyere structural target. The previously unexplored area, in the Yamarna Greenstone Belt, is approximately 1000km north-east of Perth.

The Gruyere zone of mineralisation, which is open ended, is interpreted to have at least a 400m strike length, up to 165m wide and to a vertical depth of 88m. Gold was intercepted in each of the eight drill holes, over almost the entire length of the drill holes. Best intercepts included 52m at 1.23 g/t Au from surface and 40m at 1.16 g/t Au from 32m.

MD/CEO

Duncan Gibbs

"Gold Road is dedicated to enhancing shareholder value through strong operational performance, pioneering gold discoveries and strategic corporate development. Our commitment relies on a robust organisational capacity and our commendable ESG performance.”

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013